We recognize that responding to climate change is one of our most important management issues, and in July 2021 we endorsed the recommendations of the TCFD (Task Force on Climate-related Financial Disclosures)*. We will analyze the risks and opportunities that climate change poses to our business, reflect them in our management strategy and risk management, appropriately disclose our progress, and aim for further growth while contributing to the decarbonization of society as a whole. increase.

In addition, based on the TCFD recommendations, we will disclose “governance,” “strategy,” “risk management,” and “indicators and targets” for climate change below.

- * TCFD is an abbreviation for "Task Force on Climate-related Financial Disclosures". At the request of the G20, the Financial Stability Board (FSB) discloses climate-related information and changes climate. It was established to consider the response of financial institutions to. In June 2017, we published a recommendation to disclose the effects of climate change in financial reports of financial institutions and companies.

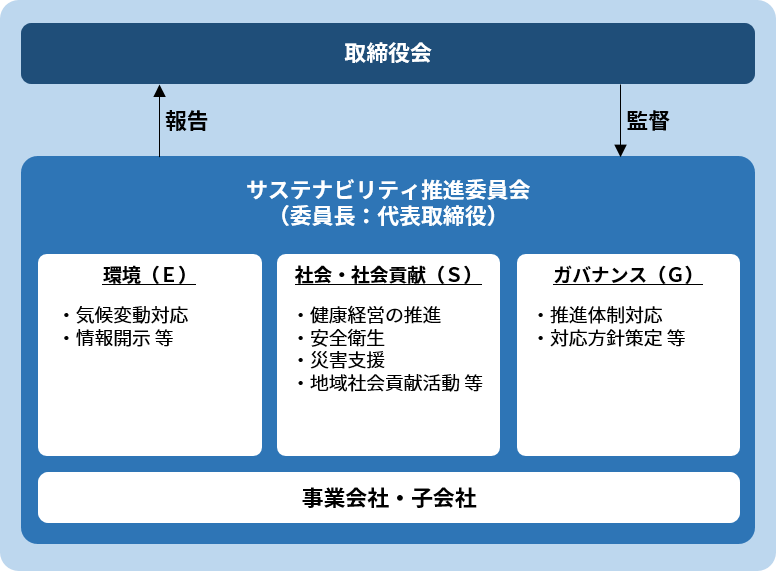

Governance

In particular, we recognize that the risks and opportunities associated with climate change will have a significant impact on our business strategies and financial plans, and in June 2022 we established the Sustainability Promotion Committee to promote sustainability management across the Group. Did.

The Sustainability Promotion Committee considers climate change to be one of its main themes, organizes information disclosure items in accordance with the TCFD recommendations, visualizes GHG emissions, formulates response methods and sustainability response policies, and sets goals and measures. progress information and report to the Board of Directors.

In addition, as a supervisory system, the Board of Directors receives timely reports on sustainability issues, targets, and responses deliberated by the committee, deliberates as necessary, and makes resolutions.

Strategy

[Scenario analysis]

We recognize that global efforts to mitigate climate change, such as the spread of climate disasters such as typhoons and heavy rains, as well as decarbonization, are important issues that have a significant impact on management and overall business. I'm here. We conducted a scenario analysis in order to understand the risks and opportunities that climate change poses to our corporate group and their impact, as well as to examine the resilience of our corporate group's strategy and the need for additional measures assuming the world in 2030. .

As a result, it became clear that the focus issues are keeping up with changes in consumer lifestyles, responding to mitigation and adaptation to climate change, and responding to the strengthening of laws and regulations related to carbon taxes and energy conservation.

In the scenario analysis, we referred to multiple existing scenarios published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and then set the goal of the Paris Agreement, which is to prevent the global average temperature from rising before the industrial revolution. The 1.5°C/2°C Scenario assumes that global warming will be kept well below 2°C compared to the previous year and efforts will be made to limit the temperature to 1.5°C, and the 4°C Scenario assumes that greenhouse gas emissions will continue at the current pace. We envision two worlds.

IEA NZE 2050 is adopted for the "1.5℃/2℃ scenario" in which transition risks such as tightening of climate change regulations, changes in the market and consumer preferences become apparent, while physical risks such as natural disasters become apparent in " We selected SSP5-8.5 and RCP8.5 by IPCC for the 4℃ scenario. The 1.5°C and 2°C scenarios have the same trends in risks and opportunities, but the 1.5°C scenario requires a stronger response speed and activity level than the 2°C scenario. I recognize.

Assuming the world in 2030, the scope of the scenario analysis is the entire supply chain of eight group companies related to the home appliance, renovation, and logistics businesses that may be particularly affected by climate change.

In addition, considering the possibility that the impact of climate change will become apparent over a long period of time, we have defined short-term, medium-term, and long-term time horizons.

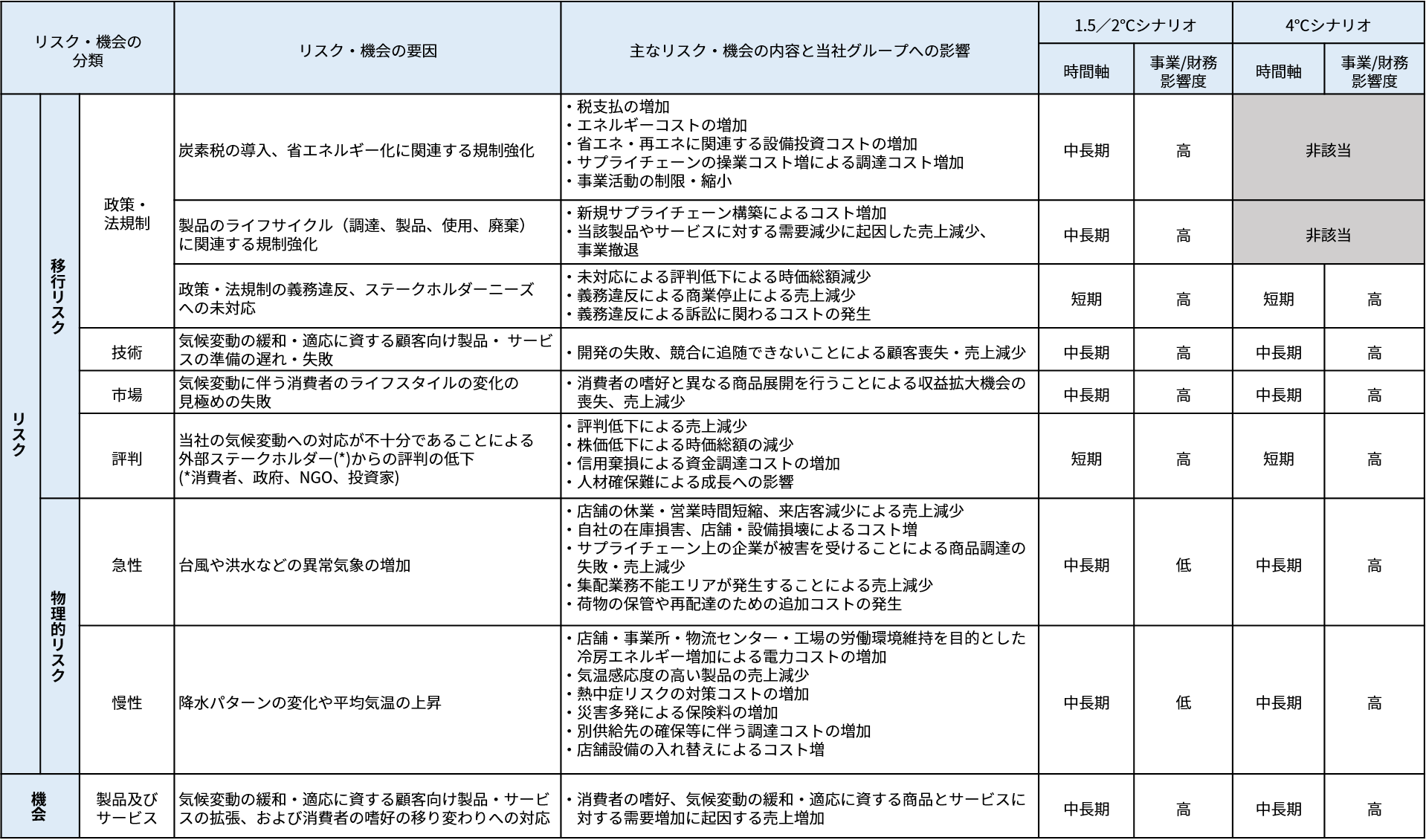

Based on these two scenarios, we extracted climate-related risks and opportunities in line with the TCFD recommendations. We then identified transition risks (policies/regulations, technology, markets, reputation), physical risks (acute and chronic), and opportunities (products and services) brought about by climate change.

| Reference scenario |

1.5/2°C Scenario: IEA NZE 2050 |

|---|---|

| Target business scope | Eight group companies related to home appliances, remodeling, and logistics businesses |

| Target year | Impact as of 2030 |

| Time axis |

Based on the fact that the effects of climate change may become apparent over a long period of time, the short-term and medium- to long-term timelines are defined as follows. ・Short-term: Current ~ 1 year ・Mid term: 1 to 5 years ・Long term: 5 years ~ |

[Scenario analysis results]

As a result of the scenario analysis, in both the 1.5°C/2°C scenario and the 4°C scenario, failure to keep up with changes in consumer lifestyles and delays in responding to climate change mitigation and adaptation have led to reputational damage. We have found that a decline is a significant risk for the Group. On the other hand, we believe that we can turn risks into opportunities by building a business strategy that can quickly respond to both 1.5°C/2°C and 4°C worlds ahead of other companies through continuous scenario analysis. I'm here.

For example, in the 1.5°C/2°C scenario, it is assumed that regulations related to carbon taxes and energy conservation will be strengthened, which will lead to an increase in costs for our corporate group. As of 2030, the risk that will have the greatest financial impact is the increase in costs due to the introduction of a carbon tax, which is expected to have an impact of approximately 1.7 billion yen.

However, with the progress of regulations on energy conservation and building ZEB toward decarbonization, regulations on greenhouse gas emissions are being strengthened, and responses to the accompanying changes in social awareness are being promoted, energy efficiency is high. We believe that the expansion of demand for products with low greenhouse gas emissions is also an opportunity for our corporate group, which develops home appliances and renovation businesses.

In addition, in the 4°C scenario, as a result of the intensification of natural disasters, it is expected that there will be damage due to the disaster, and that sales opportunities will be lost due to delays in delivery due to disruptions in the supply chain. However, as the average temperature rises, the energy consumption of air conditioning will increase in order to keep the temperature and humidity of the company constant, and the air conditioning cost is expected to increase. is also an opportunity for our corporate group.

By recognizing the impact of climate-related risks and considering countermeasures through this scenario analysis, we will realize opportunities to reduce business risks and create value for our corporate group, and achieve sustainable and stable earnings over the long term. We aim to ensure that

Our main risks and opportunities are as follows.

[Identifying risks and opportunities due to climate change]

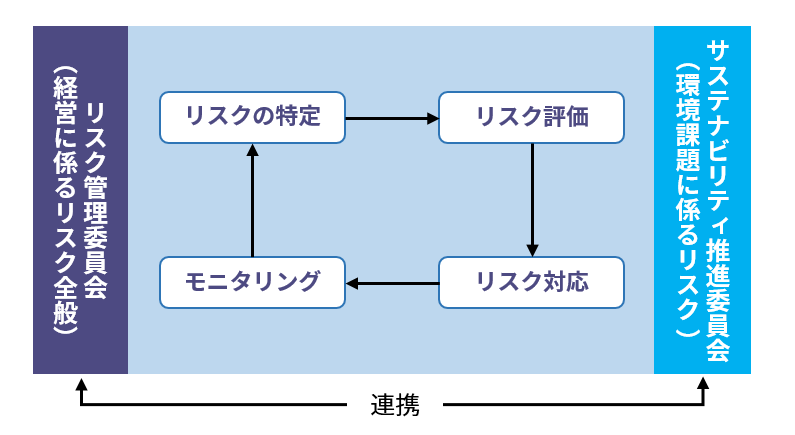

Risk management

The Company has established risk management rules for basic policies and management systems for risk management that affect the entire Group. Based on these regulations, we have established a Risk Management Committee to comprehensively manage the risks surrounding our group companies.

The Risk Management Committee identifies risks that may have a negative impact on the Group's business, evaluates the degree of impact and likelihood of occurrence, and verifies the importance of risks. Furthermore, we determine management targets and specific countermeasures for assumed risks, and continuously monitor progress. The status of risk management is reported to the Board of Directors.

The Sustainability Promotion Committee evaluates and manages risks and opportunities related to climate change, such as CO2 emission regulations. We manage company-wide risks and opportunities related to climate change, and discuss, determine, and report to the Board of Directors on methods for identifying, evaluating, and managing risks and opportunities. Identified climate change-related risks are classified into transition risks and physical risks, and the financial impact of risks and opportunities is evaluated. After identifying important risks and opportunities, discuss with the Risk Management Committee and respond. We are considering measures.

Indicators and targets

Our company aims to reduce the amount of greenhouse gas emissions, and is promoting the introduction of energy-saving equipment such as LED lighting and clean energy equipment. In addition, through the provision of energy-saving products and services, we are actively working to realize a decarbonized society, such as activities that promote understanding of the importance of energy-saving products and services.

[Indicators and targets]

We have set Scope 1, 2, and 3 CO2 emissions as indicators for managing climate-related risks and opportunities, and have set and are working to reduce greenhouse gas emissions. Our goal is to reduce our corporate group's CO2 emissions by 46% compared to FY2013 by FY2030, and we expect to reduce CO2 emissions in FY2022 by 48% compared to FY2013.

[Greenhouse gas emissions (Scope 1, 2, 3)]

We are working to calculate the greenhouse gas emissions of the entire group in our business activities. The Group's Scope 1 and 2 greenhouse gas emissions in fiscal 2022 are expected to be approximately 90,444t-CO2. In addition, Scope 3 greenhouse gas emissions in fiscal 2022 are expected to be approximately 33,682t-CO2. Changes in CO2 emissions for Scope 1 and 2 of our corporate group are as follows. We are also considering the calculation of Scope 3 (indirect emissions other than Scope 1 and 2), and will proceed with the disclosure in due course.

〈EDION Group Scope 1, 2, 3 Greenhouse Gas Emission Results and Forecast〉

(Unit: t-CO2)

| 2013 | 2021 | Preliminary figures for FY2022 | FY2022-FY2013 comparison (reduction rate) | |

|---|---|---|---|---|

| Scope1 | 27,153 | 18,281 | 17,388 | 64%(△36%) |

| Scope2 | 148,892 | 78,861 | 73,056 | 49%(△51%) |

| Scope3 (partial) | 61,780 | 36,976 | 33,682 | 55%(△45%) |

| total | 237,825 | 134,118 | 124,126 | 52%(△48%) |

*Scope 1 direct emissions of the company (gas, gasoline, light oil, etc.)

Scope 2 Indirect emissions supplied by other companies (electricity, etc.)

Scope 3 Indirect emissions along the value chain, including upstream and downstream of organizational activities other than Scope 1 and 2 (Category: 1, 3, 5)