Corporate governance status

① Overview of corporate governance system

I. Overview of corporate governance system

In addition to the Board of Directors, which meets once a month in principle, the Company has established meeting bodies such as the Management Committee, which are not required to be established by law, to conduct flexible and thorough deliberations according to the importance and urgency of each issue. The Company has also established the Nomination and Remuneration Committee and the Management Discussion Meeting as advisory bodies to the Board of Directors.

The Nomination and Compensation Committee is composed of directors, the majority of whom are Independent Director, and is chaired by an independent Independent Director. It will consider matters relating to the appointment and dismissal of directors and executive officers of the Company and its subsidiaries, as well as succession plans and compensation.

The Management Discussion Meeting is comprised of Independent Director and the representative director and provides a forum for the exchange of opinions regarding important management issues.

In addition, the Audit and Supervisory Committee conducts rigorous audits of the decision-making of the Board of Directors and the execution of duties by the directors, and cooperates with the Internal Audit Department by receiving timely reports, etc. By adopting the above system, we strive to strengthen governance throughout the Group, achieve sustainable growth for the Company, and increase corporate value over the medium to long term.B. Why adopt corporate governance?

The "service-oriented retail business" that our corporate group promotes is a community-based retail business that is founded on the peace of mind and trust we receive from our stakeholders, including shareholders, customers, business partners, and the local community.

We recognize that governance within our corporate group is an important management issue in order to continue to grow in a competitive and rapidly changing business environment, and to be accepted and widely supported by the local community as a "service-oriented retailer."We have established a top management system in which prompt and accurate decision-making is carried out through appropriate delegation of authority, and important matters are executed based on the deliberation and resolution of the board of directors, and we are constantly striving to improve internal communication so that on-site information and the opinions and requests of stakeholders are promptly conveyed to directors.

We also recognize that building good relationships between our corporate group and stakeholders is an important management issue. To that end, we will ensure that our management policies are rational and persuasive from the perspective of each stakeholder, and that our decision-making processes are transparent, while also fully fulfilling our accountability to each stakeholder.

Furthermore, in order to gain the trust of our customers, it is essential that we take organizational measures to ensure that our officers and employees comply with laws and regulations. Our corporate group regards all of these issues as part of our corporate governance.

In addition, by having the directors serve as division chiefs, we aim to quickly and accurately grasp management issues, strengthen management functions, and ensure that management decisions are quickly communicated to each store. In addition, in accordance with the affiliated company management regulations, while taking into account the uniqueness and characteristics of each subsidiary, we ensure that the basic rules of EDION Group are observed, and by promoting personnel exchanges and stimulating communication between groups, we aim to unify the will of the entire group.

The Company transitioned to a company with an audit and supervisory committee through a resolution at the 23rd Ordinary General Meeting of Shareholders held on June 27, 2024. By strengthening the Board of Directors' focused discussion of policy and strategy formulation and the supervisory function for business execution, the Company aims to further strengthen and enhance corporate governance.C. Status of improvement of internal control system and risk management system

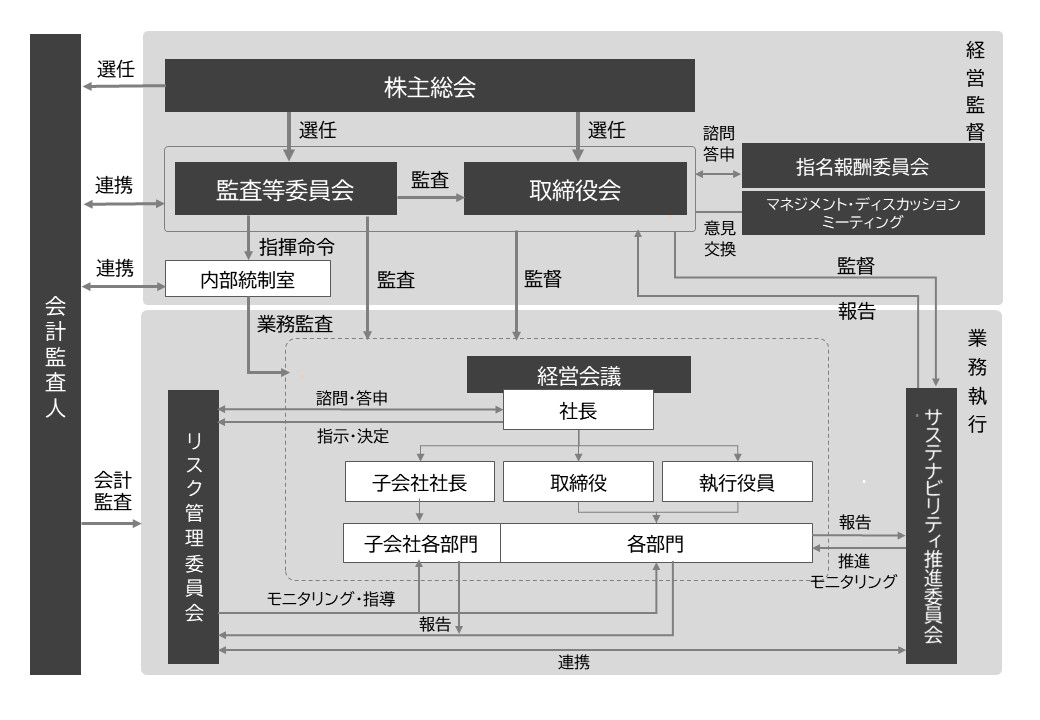

The following figure shows a schematic diagram of the state of the main group, internal control system and risk management system in the Group.

- D. Summary of the contents of the liability limitation agreement and directors and officers liability insurance (D&O insurance) and the reasons for it

The Articles of Incorporation provide that the Company may be exempted from such liability by a resolution of the Board of Directors. In addition, the Articles of Incorporation provide that the Company may enter into agreements with directors, excluding executive directors, etc., to limit the liability for damages under Article 423, Paragraph 1 of the Companies Act, pursuant to the provisions of Article 427, Paragraph 1 of the Companies Act.

Pursuant to Article 427, Paragraph 1 of the Companies Act, the Company has entered into agreements with one full-time director who is an audit and supervisory committee member and eight Independent Director to limit the liability for damages under Article 423, Paragraph 1 of the Companies Act, and the amount of such liability is set at the minimum liability limit prescribed by law.

In addition, the Company has entered into a Company Officer Liability Insurance contract with its directors and directors (audit and supervisory committee members) and its subsidiaries' directors and auditors as insured persons. The outline of the contents of the contract is to compensate the insured for damages, litigation costs, etc. incurred by the insured when a claim for damages is made due to the insured's acts in the course of their duties as a company officer. The insurance premiums are paid in full by the Company.

These are intended to enable directors to fully fulfill the roles expected of them in carrying out their duties. E. Number of directors

Our Articles of Incorporation stipulate that the number of directors excluding directors who are audit and supervisory committee members shall be 16 or less, and the number of directors who are audit and supervisory committee members shall be 5 or less.

What. Requirements for resolution of appointment of directors

Regarding the resolution for the election of directors, we state that shareholders who have one-third or more of the voting rights of the shareholders who can exercise their voting rights shall attend, and that the majority of the voting rights shall be adopted and that cumulative voting shall not be used. It is stipulated in the articles of incorporation.

G. Acquisition of own shares

Regarding the acquisition of own shares, the Articles of Incorporation stipulate in Articles 165, Paragraph 2 of the Companies Act that the Company's own shares may be acquired through market transactions, etc. by resolution of the Board of Directors. This is intended to enable flexible execution of capital policies.

blood. Interim dividend

Pursuant to the provisions of Article 454, Paragraph 5 of the Companies Act, the Company may pay an interim dividend to shareholders or registered share pledgees recorded in the final shareholder list on September 30 every year by a resolution of the Board of Directors. The articles of incorporation stipulate that to that effect. The purpose of this is to provide stable and agile return of profits to shareholders.Li. Special resolution requirements for general meetings of shareholders

At the Company, shareholders who hold one-third or more of the voting rights of shareholders who can exercise their voting rights attend the special resolution of the general meeting of shareholders stipulated in Article 309, Paragraph 2 of the Companies Act, and the voting rights 3 It is stipulated in the Articles of Incorporation that a majority, which is more than two-minutes, will be used. The purpose of this is to facilitate the operation of the general meeting of shareholders by relaxing the quorum of special resolutions at the general meeting of shareholders.

② Status of audits by the Audit and Supervisory Committee and internal audits

A. Status of audits by the Audit and Supervisory Committee

(1) Organization and personnel of the Audit and Supervisory Committee

At the Ordinary General Meeting of Shareholders held on June 27, 2024, the Company transitioned from a company with an audit and supervisory board to a company with an audit and supervisory committee.

The Audit and Supervisory Committee is composed of four directors (three men and one woman), including three independent Independent Director with specialized knowledge as certified public accountants, corporate management and finance, and lawyers. In the current fiscal year, Yoshikiyo Sakai, Independent Director Audit and Supervisory Committee member, is the chairman of the Audit and Supervisory Committee. He has ample practical experience as a person in charge of the financial accounting department and an executive director of a company operating in the telecommunications network business, and has considerable knowledge of financial accounting and tax matters. Yuki Fukuda, Independent Director Audit and Supervisory Committee member, is a certified public accountant and tax accountant, and has considerable knowledge of financial accounting and tax matters. Hideaki Shimizu, Independent Director Audit and Supervisory Committee member, has sufficient insight to audit and supervise management based on his experience in corporate law as a lawyer and his specialized knowledge. Yoshie Yamane, a full-time Audit and Supervisory Committee member, has extensive experience in the management department of the Company and its subsidiaries, and has extensive business knowledge necessary for the audit system through extensive information gathering and sufficient cooperation with the internal audit department (internal control office). In addition, the Audit and Supervisory Committee has established an Audit and Supervisory Committee Secretariat to assist the Audit and Supervisory Committee members in their duties, with dedicated staff to assist with matters necessary for the Audit and Supervisory Committee to carry out its duties, such as providing instructions for collecting information, running meetings as the secretariat, and coordinating liaison between the Audit and Supervisory Committee members.

(2) Activities of the Audit and Supervisory Committee

During this fiscal year, the Board of Auditors met three times before the transition to a company with an audit and supervisory committee on June 27, 2024, and the Audit and Supervisory Committee met seven times thereafter by the end of this fiscal year, with all four Audit and Supervisory Board Members and four Directors who are also audit and supervisory committee members attending. The main agenda items discussed and resolved at the Audit and Supervisory Committee during this fiscal year are as follows:

・Audit report of the Board of Auditors for the previous fiscal year

- Consent regarding the estimated audit fees of the accounting auditor

・Selection of the Chairman of the Audit and Supervisory Committee, full-time Audit and Supervisory Committee members, and selected Audit and Supervisory Committee members

・Establishment of rules for the Audit and Supervisory Committee

・Establishment of standards for audit and supervisory committee audits and implementation standards for audit and supervisory committee audits related to internal control systems

・Basic audit policy of the Audit and Supervisory Committee ・Audit implementation plan ・Division of audit duties

・Remuneration for directors who are audit and supervisory committee members (discussion)

- Whether or not to reappoint the accounting auditor based on the evaluation

・Opinions regarding the appointment, etc. of directors (excluding directors who are audit and supervisory committee members) and remuneration, etc.

・Approval of transactions that may involve a conflict of interest for directors

- Annual audit plan of the accounting auditor

-Evaluation of the suitability of accounting auditors

・Matters to be discussed by the business execution division

・Audit report from accounting auditor

・Internal audit plans and audit result reports from the Internal Control Office

・Audit activity report from the full-time audit and supervisory committee member

With regard to the "Key Audit Matters" (KAMs) stated in the accounting auditor's audit report based on the Financial Instruments and Exchange Act, the accounting auditor and the Audit and Supervisory Committee held repeated discussions in cooperation with the executive department throughout the fiscal year, and confirmed the appropriateness and consistency of information disclosure on items involving important management judgment, including accounting estimates. In addition, twice a year, EDION Group Audit Liaison Conference was held, bringing together the accounting auditor, the Audit and Supervisory Committee members, the Internal Control Office, the Finance and Accounting Department, and the auditors of subsidiaries, where the accounting auditor explained the audit results, a question-and-answer session was held, and opinions were exchanged to share current issues.

(3) Activities of Directors who are Audit and Supervisory Committee Members

The directors who are Audit and Supervisory Committee members of our company conduct audits in accordance with the basic audit policy, audit implementation plan, and division of audit duties established by the Audit and Supervisory Committee. Their main activities are as follows: ・Held meetings to exchange opinions with the Representative Director and other executive directors and made recommendations regarding high-risk management issues.

・In the sustainability audit, we interviewed the person in charge of the sustainability promotion department about the progress of our materiality and our response to climate change, and audited sustainability management. Directors who are full-time audit and supervisory committee members participate in the Sustainability Promotion Committee as members, auditing the status of deliberations such as the review of materiality and expressing opinions as appropriate. ・ Independent Director who are audit and supervisory committee members audited the status of the execution of duties by directors and employees, etc., through attendance at board meetings and management policy presentation meetings, inspections of important business sites, etc. In addition, Independent Director who are audit and supervisory committee members who attend the voluntary Nomination and Remuneration Committee, an advisory body to the Board of Directors, audit the appropriateness of the deliberation and decision-making process for the appointment, etc. of directors (excluding directors who are audit and supervisory committee members) and remuneration, etc.

・The full-time directors who are audit and supervisory committee members communicated with the executive directors, the Internal Control Office and other employees in their daily audit activities, endeavored to collect information and improve the audit environment, attended important meetings such as the Management Committee, the Award and Disciplinary Committee and the Risk Management Committee, received reports from the executive directors and employees on the status of their execution of duties, requested explanations as necessary, and inspected important approval documents. In addition, they accompanied the Internal Control Office on its on-site inspections at the head office and major stores to audit the status of operations and assets. For physical inventory, they accompanied the accounting auditors to major stores and audited whether accurate inventory was being conducted. The full-time directors who are audit and supervisory committee members reported these audit activities and audit results to the audit and supervisory committee as appropriate.

With regard to subsidiaries, in the case of subsidiaries where directors who are full-time Audit and Supervisory Committee members also serve as part-time Audit and Supervisory Board members, they attended board meetings and accompanied the Internal Control Office or the Accounting Auditor on audits, including at other subsidiaries, to communicate and exchange information with the directors and Audit and Supervisory Board members of the subsidiaries, etc., and received business reports from the subsidiaries as necessary and audited their risk management systems.

The status of activities of the Audit and Supervisory Committee during the fiscal year under review is regularly reported to the Board of Directors.

B. Status of internal audits

The purpose of our internal audits is to prevent fraud and errors, provide accurate management information, preserve assets, and improve business activities by verifying, evaluating and advising on whether the company's organization, systems and operations are in compliance with management policies and regulations and are being operated efficiently, thereby contributing to the promotion of management efficiency.

The Internal Control Office (27 members as of the date of submission of this report), an organization that reports directly to the Representative Director, Chairman and CEO and is independent from the business execution division, audits sales stores, logistics service bases, head office departments, and subsidiaries based on the annual internal audit plan. It audits the business execution status of each division to ensure that it is being operated appropriately and effectively in accordance with laws, internal regulations, and various handling procedures, notifies the audited division of the audit results, provides advice on business improvement and prevention of fraud and errors, and strives to strengthen effectiveness through appropriate follow-up. The Internal Control Office also audits matters deemed necessary by the Board of Directors and the Audit and Supervisory Committee, and evaluates the establishment and operation of internal controls related to financial reporting pursuant to the Financial Instruments and Exchange Act.

The results of internal audits and internal control evaluations are reported directly to the Chairman and CEO, as well as to the Board of Directors and the Audit and Supervisory Committee.

The Internal Control Office reports and exchanges information with the directors who are audit and supervisory committee members, the audit and supervisory committee, and the accounting auditors on a regular basis or as necessary, in order to strengthen mutual cooperation. In addition, the head of the Internal Control Office attends EDION Group Audit Liaison Conference and the Risk Management Committee to share information on risk issues of the Company and its subsidiaries and to work on improvement measures.

C. Status of accounting audit

The Company has appointed Ernst & Young ShinNihon LLC as its accounting auditor under the Companies Act and as its accounting audit under the Financial Instruments and Exchange Act, but there are no special interests between the Company and said audit firm or the employees of said audit firm who are engaged in auditing the Company. In addition to statutory audits, the Company regularly exchanges opinions, including audit reports, between the Audit & Supervisory Board Members and the Internal Audit Office.

Name of the audit firm

EY ShinNihon LLC

b. Certified public accountant who performed the business

Osamu Suwabe

Kenichiro Kobayashi

c. Composition of assistants involved in audit work

The accounting audit work of our company is assisted by 11 certified public accountants and 21 other personnel.

d. Policy and reasons for selecting auditing firm

The Company has established the following standards for appropriately selecting candidates for external accounting auditors and for properly evaluating external accounting auditors.

(1) Quality control system

・The quality control system of the external accounting auditor must be such that the external accounting auditor reports on the quality system every year and appropriate measures can be taken to ensure proper audits.

・There have been no significant findings that could affect the quality control system in external reviews (Certified Public Accountants and Audit Oversight Board inspections, Japanese Institute of Certified Public Accountants quality control reviews, etc.)

(2) Audit Plan

・Formulate an audit plan that is in line with the industry and company environment

・The audit plan must reflect requests from the auditors.

We check whether an external accounting auditor has the required independence and expertise based on the following three criteria.

(1) The external accounting auditor and the audit team maintain the independence required by the Certified Public Accountant Act and other laws.

(2) The audit team includes members with the knowledge and experience to conduct audits according to the audit plan.

(3) In cases where there are complex and important areas of expertise, professionals other than accounting and auditing are used.

If the Audit & Supervisory Board determines that it is difficult for the Accounting Auditor to perform its audits properly or otherwise deems it necessary, it will determine the content of a proposal to be submitted to the General Meeting of Shareholders regarding the dismissal or non-reappointment of the Accounting Auditor.

Furthermore, if the Audit & Supervisory Board finds that the Accounting Auditor falls under any of the items set out in Article 340, Paragraph 1 of the Companies Act, the Audit & Supervisory Board will dismiss the Accounting Auditor with the consent of all Audit & Supervisory Board Members. In this case, an Audit & Supervisory Board Member selected by the Audit & Supervisory Board will report the dismissal of the Accounting Auditor and the reason for the dismissal at the first General Meeting of Shareholders convened after the dismissal.

e. Evaluation of the audit firm by the auditors and the board of auditors

The Audit & Supervisory Board members and the Board of Auditors monitored and verified whether the Accounting Auditor maintained its independence and conducted appropriate audits, and received reports from the Accounting Auditor on the status of the execution of its duties and requested explanations when necessary.

In addition, we received notification from the accounting auditor that the "system to ensure that duties are performed appropriately" (matters set out in each item of Article 131 of the Corporate Accounting Regulations) has been established in accordance with the "Quality Control Standards for Audits" (Business Accounting Council, November 16, 2021), and requested explanations as necessary. Based on this, we have comprehensively evaluated the accounting auditor's audit implementation status, quality control system, independence and expertise, and have determined that there are no issues with the eligibility of EY ShinNihon LLC.

③ Independent Director and Auditor

Our company has five Independent Director and three Independent Director (audit and supervisory committee members).

Independent Director (audit and supervisory committee members) are the majority of the total number of directors (audit and supervisory committee members) (four members) and the auditors who meet the audit and supervisory committee requirements set out in the articles of incorporation.

The required number of directors serving as audit and supervisory committee members (up to five persons) has been met, and the current lineup is performing its auditing functions adequately.

- A. Personal relationships, capital relationships, business relationships, or other interests between the Company and Independent Director and Independent Director (audit and supervisory committee members)

There are no special interests between the Company and its Independent Director or Independent Director (audit and supervisory committee members) that need to be disclosed. - B. Personal, capital, business or other interests between the Company and other companies in cases where Independent Director or Independent Director (audit and supervisory committee member) is or was an officer or employee of another company

Independent Director Shozo Ishibashi concurrently serves as Representative Director of the Ishibashi Tanzan Memorial Foundation, Independent Director of Minkabu the Infonoid Co., Ltd., and a trustee of the Kurimoto Gakuen School Corporation. He has previously worked for Nomura Research Institute Ltd., Nomura Securities Co., Ltd., Lehman Brothers Securities Co., Ltd., Tokyo Medical and Dental University, and Rissho University. However, there is no special relationship of interest between the Company and these companies or corporations.

Independent Director Shigefumi Takagi established the Takagi Law Office and has previously worked for Blakemore LLP, Adachi, Henderson, Miyatake & Fujita LLP, Baker & McKenzie LLP, and White & Case LLP. However, there is no special interest between the Company and these entities.

Independent Director Naoko Mayumi concurrently serves as Representative Director and President of Algorab Inc. and has previously worked for Okasan Securities Co., Ltd., Deutsche Asset Management Japan Ltd., UBS Asset Management Japan Ltd. and Lazard Japan Asset Management Japan Ltd. However, there is no special interest between the Company and these companies.

Independent Director Yoshihiko Fukushima is a professor at the Faculty of Political Science and Economics, Waseda University, and was previously affiliated with Citigroup Global Markets Japan Inc., Royal University of Stockholm, and Nagoya University of Commerce and Business. However, there is no special interest between the Company and these companies or corporations.

Independent Director Tadashi Mori concurrently Independent Director Independent Director Communications Holdings Inc. and Silver Egg Technology Co., Ltd., and has previously held positions at Hankyu Department Stores Co., Ltd., H2O Retailing Co., Ltd., Ume no Hana Co., Ltd., and Kansai Supermarkets Co., Ltd.; however, there is no special interest between the Company and these companies.

Yuki Fukuda, Independent Director (audit and supervisory committee member), established the Fukuda Certified Public Accountant and Tax Accountant Office, concurrently serves as an auditor for Seiko Co., Ltd., and was previously employed by Ernst & Young ShinNihon LLC. However, there is no special conflict of interest between the Company and said firm.

Independent Director (Audit and Supervisory Committee member) Yoshikiyo Sakai concurrently serves as Executive Adviser for NTT Finance Corporation and has previously worked for NTT Docomo, Inc., Nippon Telegraph and Telephone East Corporation, and Nippon Telegraph and Telephone Corporation. However, there is no special interest between the Company and these companies.

Independent Director (Audit and Supervisory Committee member) Hideaki Shimizu has established the Hideaki Shimizu Law Office and was previously affiliated with the Yamada Law Office and the Uehara & Shimizu Law Office. However, there is no special conflict of interest between the Company and said company. - C. Functions and roles of Independent Director and outside auditors in the Company's corporate governance

Independent Director Shozo Ishibashi has extensive experience and knowledge in corporate management and finance, and he draws on his own experience and knowledge in his activities, including speaking at board meetings and serving as chairman of the voluntary Nomination and Remuneration Committee, an advisory body to the board of directors.

Independent Director Takagi Noriyuki has experience and specialized knowledge in corporate law as an attorney, and makes statements at board meetings and other occasions based on his own experience and knowledge.

Independent Director Naoko Mayumi is performing her duties as our company's Independent Director appropriately, including providing advice based on her extensive experience in the finance and securities sectors.

Independent Director Yoshihiko Fukushima has never been involved in company management in any way other than as an outside officer, but he is performing his duties as our Independent Director appropriately, including providing advice based on his knowledge as an academic in the fields of economics and management.

Independent Director Tadashi Mori is performing his duties as our company's Independent Director appropriately, including providing advice based on his extensive experience and knowledge as an executive director of a retail company.

Yuki Fukuda, Independent Director (audit and supervisory committee member), is a certified public accountant and tax accountant and has a considerable degree of knowledge regarding finance and accounting.

Independent Director (Audit and Supervisory Committee Member) Yoshikiyo Sakai has been performing his duties as our outside director appropriately, including providing recommendations and advice from an independent and objective standpoint, based on his abundant experience and knowledge as a person in charge of the finance and accounting department and as Independent Director of a company operating in the telecommunications network business.

Independent Director (Audit and Supervisory Committee member) Hideaki Shimizu has experience and specialized knowledge in corporate law as an attorney. D. Our approach regarding the appointment of Independent Director and outside auditors

As standards for appointing Independent Director and outside auditors, the Company satisfies the provisions of the Companies Act and the Stock Exchange's "Guidelines for Listing Management, etc.", and has also established its own independence standards, as set forth below.

Furthermore, all five Independent Director and three Independent Director (audit and supervisory committee members) meet the requirements for independent directors set by the stock exchange and also meet our own standards, thereby maintaining their independence.< Independence criteria >

Persons who do not meet any of the criteria set out below

a. A person who currently or previously executed business operations for the Company or any of its subsidiaries

- b. An executive officer currently belonging to a major shareholder or an organization that is a major shareholder with a voting rights ratio of 10% or more in the most recent shareholder register of the Company

- c. An executive officer currently working for a business partner or its consolidated subsidiary whose total transaction amount with the Company exceeded 2% of Consolidated net sales of the Company or the business partner at least once during the most recent three fiscal years.

- d. A consultant, accounting professional, legal professional, accounting auditor, or advisory contract partner who has received an average of 10 million yen or more in cash or other assets from the Company in the most recent three fiscal years other than officer compensation (if such a partner is an organization such as a corporation or association, an executive officer of such organization)

- e. A director or other executive officer of an organization that has received donations from the Company in excess of the greater of 10 million yen or 2% of Net sales or total income during the past three fiscal years.

- If you were previously affiliated with any of the organizations or business partners listed in b through e, you have left those organizations or business partners within the past year, and you are the spouse or a relative within the second degree of kinship of the Company or any of the business executives listed in a through e.

- E. Supervision or audits by Independent Director or Independent Director (audit and supervisory committee members) and internal audits, cooperation between the audit and supervisory committee and accounting audits, and relationships with the internal control department

Independent Director and Independent Director (audit and supervisory committee members) attend the board of directors meetings, which are held once a month in principle, and conduct thorough deliberations. They also hold individual meetings with other management members and each department as necessary, and inspect the Company's stores, logistics centers, etc., to exchange opinions.

Each director (audit and supervisory committee member), including Independent Director (audit and supervisory committee members), regularly exchanges information with the accounting auditor to receive reports on the audit plan, audit implementation status, and issues raised during the audit, as well as share information and exchange opinions regarding the audit.

In addition, the Internal Audit Department periodically reports to the Audit and Supervisory Committee to obtain information regarding the internal audit plan, structure, status of internal audit implementation, and issues raised during the audit. When necessary, the Audit and Supervisory Committee issues instructions to the staff of the Internal Audit Department regarding assisting the Audit and Supervisory Committee.

④Remuneration of officers

A. Total amount of remuneration for each executive category, total amount by type of remuneration, and number of eligible executives

Officer classification Such as rewards

the amount

(One million yen)Total amount by type of compensation (million yen) Target

Officer's

Number of members (people)Basic

RewardPerformance linked

RewardNon-monetary

RewardDirectors (excluding Audit and Supervisory Committee members and Independent Director) 636

426

141

69

7

Directors (Audit and Supervisory Committee Members) (excluding Independent Director) 10

10

-

-

1

Auditors (excluding outside auditors) 3

3

―

―

1

Outside officer 76

76

―

―

11

(Notes) 1. The total amount of remuneration for Directors above does not include the employee salaries of Directors who also serve as employees.

2. The performance indicator for performance-linked remuneration, etc. is Profit attributable to owners of parent, which is set to be 14,118 million yen for the fiscal year ending March 2025.3. "Non-monetary compensation, etc." by type of compensation for directors (excluding Independent Director) is restricted stock compensation of 69 million yen.

B. Total amount of remuneration, etc. of persons whose total amount of remuneration, etc. is 100 million yen or more

Full name Officer classification Company classification Total amount by type of compensation (million yen) Such as rewards

the amount

(One million yen)Basic reward Performance linked

RewardOther Masataka Kubo Director Submission

Company163

78

29

270

Satoshi Kaneko Director Submission

Company96

7

6

109

(Notes) 1. The "non-monetary compensation, etc." category for Masataka Kubo is restricted stock compensation of 29 million yen.

2. The "non-monetary compensation, etc." category of compensation, etc. paid to Satoshi Kaneko is 6 million yen in the form of restricted stock compensation.

⑤Shareholding status

B. Number of issues and amount on balance sheet

Number of brands (brands) On the balance sheet

Total amount (million yen)Unlisted stock ― ― Non-listed shares 4 3,088

(Issues whose shares decreased during the current fiscal year) Number of brands (brands) Acquisition price related to the increase in the number of shares

Total amount (million yen)Unlisted stock ― ― Non-listed shares ― ― B. Information on the number of shares, balance sheet amounts, etc. for each stock of specific investment shares and deemed holding shares

Specified investment stock Brand This business year Previous business year Holding purpose,

Quantitative

Holding effect and

The number of shares

Reasons for increaseOf our stock

PossessionNumber of shares (shares) Number of shares (shares) Balance sheet

Recorded amount (million yen)Balance sheet

Recorded amount (million yen)㈱Hiroshima Bank 1,146,000 1,146,000 Stable

Maintain financial transactionsYes 1,250 717 ㈱Mitsubishi UFJ Financial Group 504,420 504,420 Stable

Maintain financial transactionsYes 785 427 ㈱Sanae 77,200 77,200 Business transactions

(franchised contracts)

Medium to long term

Relationship maintenanceNothing 362 314 Aichi Financial Group Co., Ltd. 70,284 70,284 Stable

Maintain financial transactionsYes 186 151 (Note) If the issue is a holding company, the presence or absence of shares of the Company is stated in consideration of the shares held by its major subsidiaries (the number of shares actually owned).

C. Investment stocks held for pure investment purposes

Classification This business year Previous business year Number of brands (brands) On the balance sheet

Total amount (million yen)Number of brands (brands) On the balance sheet

Total amount (million yen)Unlisted stock 21

2,191

21

2,191

Non-listed shares 4

53

4

47

Classification This business year Dividend income

Total amount (million yen)Of gain or loss on sale

Total amount (million yen)Of valuation loss

Total amount (million yen)Unlisted stock 54

―

(note)-

Non-listed shares 0

-

31

(Note) For unlisted stocks, there is no market price, and it is considered extremely difficult to determine the market value.

Details of audit fees

Remuneration for auditing certified public accountants

a.Remuneration for auditing certified public accountants, etc.

Classification | Previous consolidated fiscal year | Current consolidated fiscal year | ||

|---|---|---|---|---|

| For audit certification work Remuneration (million yen) | For non-audit work Remuneration (million yen) | For audit certification work Remuneration (million yen) | For non-audit work Remuneration (million yen) | |

| Submitting company | 102 | 3 | 111 | 2 |

| Consolidated subsidiary | ― | ― | ― | ― |

| Total | 102 | 3 | 111 | 2 |

(Note) The fees paid by the filing company for audit and attestation services in the previous consolidated fiscal year include an additional fee of 1 million yen. In addition, the fees paid by the filing company for non-audit services in the previous consolidated fiscal year are for advisory services related to new lease accounting. The fees paid by the filing company for audit and attestation services in the current consolidated fiscal year include an additional fee of 10 million yen. In addition, the fees paid by the filing company for non-audit services in the current consolidated fiscal year are for advisory services related to new lease accounting.

b. Compensation for organizations belonging to the same network (Ernst & Young member firms) as audit certified accountants (excluding a.)

Not applicable.

c. Remuneration for other important audit certification services

Not applicable.

d. Policy for determining audit fees

It is determined after considering the size, characteristics, number of audit days, etc.

e. Reasons for the Board of Corporate Auditors to agree to the remuneration of the Accounting Auditor

The Board of Auditors conducts necessary reviews and deliberations as to whether the audit plan of the accounting auditor, the status of the duties of accounting audits, and the basis for calculating remuneration estimates are appropriate, and after deliberation, the amount of remuneration, etc. of the accounting auditor Has deemed appropriate and has consented to Article 399, Paragraph 1 of the Companies Act.

Director Skills Matrix

The main skills and experience possessed by each director, as well as expected roles, etc. are marked with a ●.

Full name | Position | Business Management Business Strategy | Financial Accounting Tax | sales Marketing | Store Development | IT/DX | Logistics Logistics | human resources Human Resources Development | Legal Affairs Risk Management | Internal Control Governance | Sustainer Ability |

|---|---|---|---|---|---|---|---|---|---|---|---|

Masataka Kubo | 代表取締役 Chairman, Executive Officer and CEO | ● | ● | ● | ● | ● | ● | ● | |||

Norio Yamazaki | 代表取締役 Vice Chairman | ● | ● | ● | ● | ● | ● | ● | |||

Kozo Takahashi | 代表取締役 President and COO | ● | ● | ● | ● | ● | ● | ● | |||

Aki Ishida | Director Managing Executive Officer | ● | ● | ● | ● | ● | ● | ● | |||

Toshiro Inoue | Director Senior Executive Officer | ● | ● | ||||||||

Yuji Ikebata | Director Senior Executive Officer | ● | ● | ● | |||||||

Hirokazu Fujiwara | Director Senior Executive Officer | ● | ● | ● | ● | ||||||

Shozo Ishibashi | Independent Director | ● | ● | ● | ● | ||||||

Takagi Shigefumi | Independent Director | ● | ● | ● | ● | ||||||

Mayumi Naoko | Independent Director | ● | ● | ● | ● | ||||||

Yoshihiko Fukushima | Independent Director | ● | ● | ● | ● | ● | |||||

Tadatsugu Mori | Independent Director | ● | ● | ● | ● | ● | |||||

Yoshie Yamane | Director Full-time Audit and Supervisory Committee Member | ● | ● | ● | ● | ● | |||||

Yuki Fukuda | Independent Director Audit and Supervisory Committee Members | ● | ● | ● | |||||||

Yoshikiyo Sakai | Independent Director Audit and Supervisory Committee Members | ● | ● | ● | ● | ● | |||||

Hideaki Shimizu | Independent Director Audit and Supervisory Committee Members | ● | ● |