The Group recognizes that responding to climate change is one of its important management issues, and endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)* in July 2021. We will analyze the risks and opportunities that climate change poses to our Group's business, reflect them in our management strategy and risk management, and appropriately disclose our progress, aiming for further growth while contributing to the decarbonization of society as a whole.

Based on the TCFD recommendations, we disclose below our "governance," "strategy," "risk management," and "metrics and targets" regarding climate change.

- * TCFD is an abbreviation for "Task Force on Climate-related Financial Disclosures". At the request of the G20, the Financial Stability Board (FSB) discloses climate-related information and changes climate. It was established to consider the response of financial institutions to. In June 2017, we published a recommendation to disclose the effects of climate change in financial reports of financial institutions and companies.

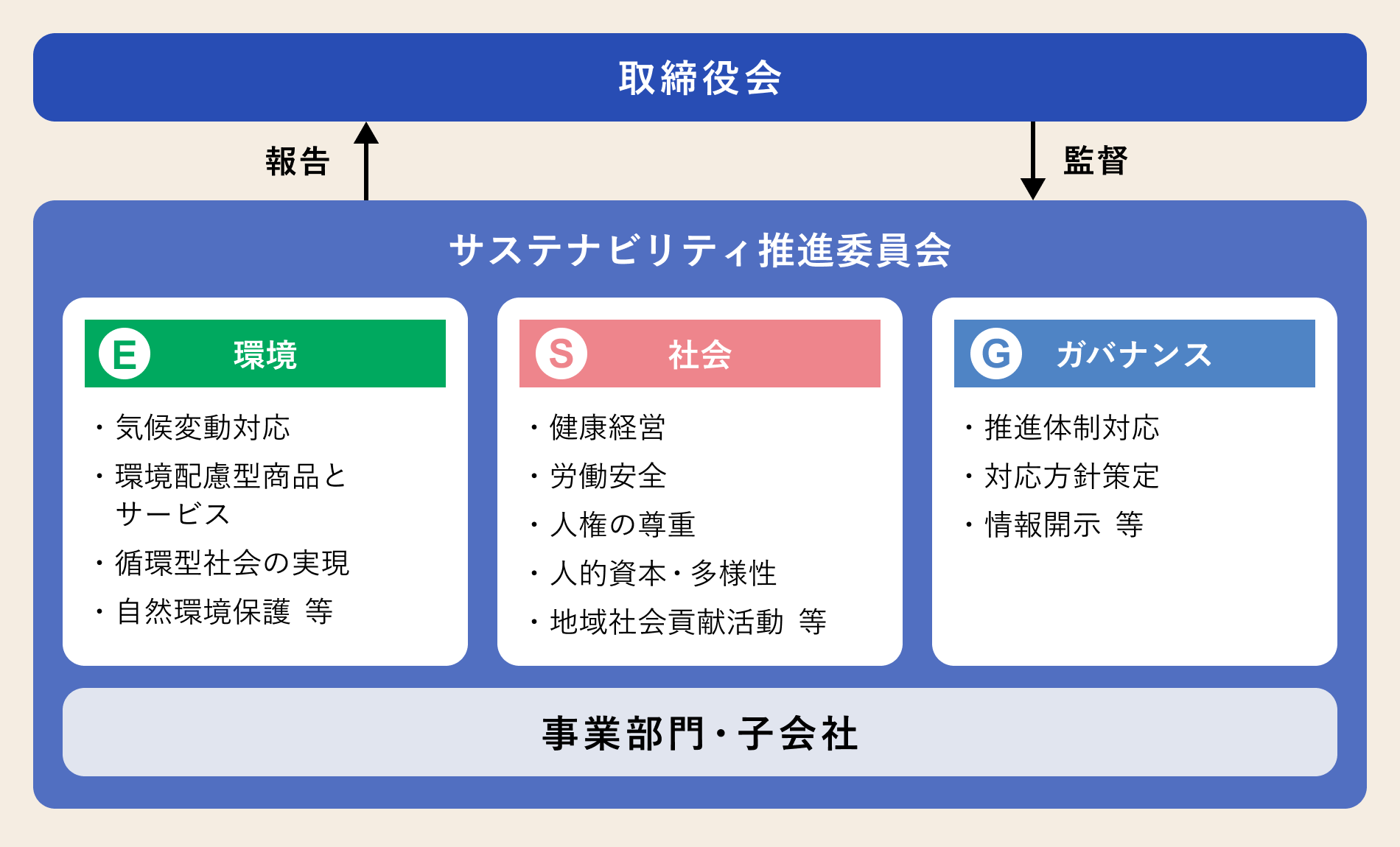

Governance

Our Group recognizes that the risks and opportunities associated with climate change will have a significant impact on our business strategies and financial plans, and in order to promote sustainability management across the entire Group, we established the Sustainability Promotion Committee in June 2022.

The Sustainability Promotion Committee regards climate change as one of its main themes, and organizes information disclosure items in accordance with the TCFD recommendations, considers ways to visualize and reduce CO2 emissions, discusses important matters related to climate change and formulates response policies, etc., while also grasping the progress of measures toward targets and reporting to the Board of Directors.

Additionally, as a supervisory body, the Board of Directors receives timely reports on the issues, goals, and responses regarding climate change discussed by the Sustainability Promotion Committee, and makes decisions on important matters after deliberation.

Strategy

[Scenario analysis]

The Group recognizes that the expansion of climate-related disasters, such as the intensification of typhoons and heavy rains, and global efforts to mitigate climate change, such as decarbonization, are important issues that will have a significant impact on management and the entire business. We conducted a scenario analysis to understand the risks and opportunities that climate change poses to the Group and their impacts, and to consider the resilience of the Group's strategy and the need for additional measures, assuming the world as of 2030.

As a result, it became clear that the key issues were keeping up with changes in consumer lifestyles, responding to climate change mitigation and adaptation, and responding to strengthened laws and regulations regarding carbon taxes and energy conservation.

The scenario analysis referred to multiple existing scenarios published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and assumed two worlds: the "1.5°C/2°C scenario," which assumes that the Paris Agreement's goal of "keeping the global average temperature rise well below 2°C above pre-industrial levels and making efforts to limit it to 1.5°C," and the "4°C scenario," which assumes that greenhouse gas emissions will continue at the current pace.

We selected IEA NZE 2050 for the "1.5°C/2°C scenario," in which transition risks such as strengthening climate change-related regulations, market changes, and consumer preferences become apparent, and IPCC's SSP5-8.5 and RCP8.5 for the "4°C scenario," in which physical risks such as natural disasters become apparent. Note that while the trends in risks and opportunities are the same in the 1.5°C and 2°C scenarios, we recognize that there is a greater need to strengthen the speed and level of response to climate change in the 1.5°C scenario than in the 2°C scenario.

The scope of the scenario analysis was based on a hypothetical world scenario for 2030, and covered the entire supply chains of eight Group companies involved in the home appliance, renovation, and logistics businesses that are likely to be particularly affected by climate change.

Additionally, given that the effects of climate change may take a long time to become apparent, we have defined short-term, medium-term and long-term timescales.

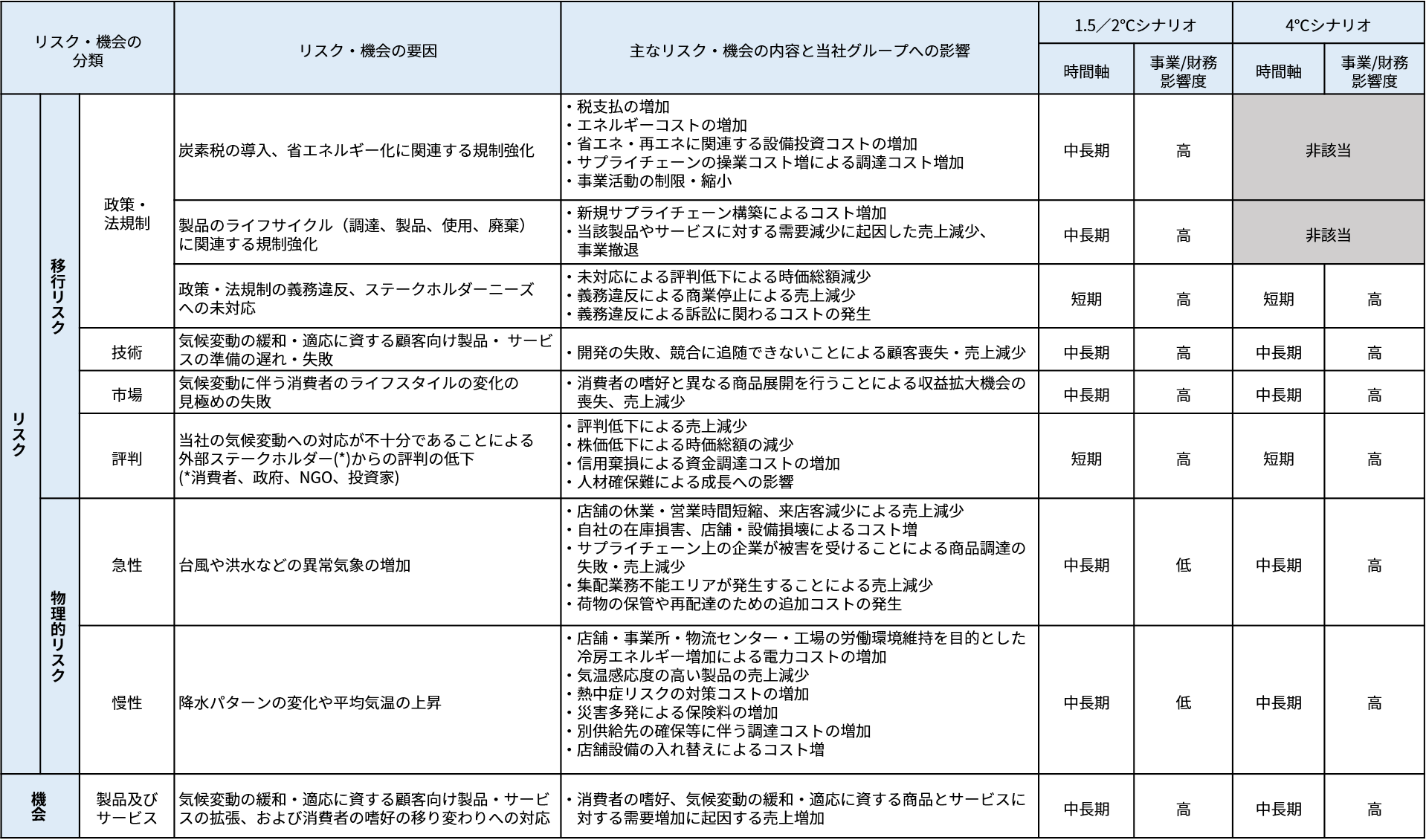

Based on these two scenarios, we extracted climate-related risks and opportunities in line with the TCFD recommendations. We then identified transition risks (policy/legal regulations, technology, market, reputation), physical risks (acute and chronic), and opportunities (products and services) that are brought about by climate change.

| Reference scenario | 1.5/2°C scenario: IEA NZE 2050 4°C scenario: IPCC SSP5-8.5, RCP8.5 |

|---|---|

| Target business scope | Eight group companies related to home appliances, renovations, and logistics businesses |

| Target year | Impact as of 2030 |

| Time axis | Based on the fact that the effects of climate change may become apparent over a long period of time, the short-term and medium- to long-term timelines are defined as follows.

・Short-term: Current to 1 year ・Medium term: 1 to 5 years ・Long term: 5 years ~ |

[Scenario analysis results]

As a result of the scenario analysis, we found that in both the 1.5℃/2℃ and 4℃ scenarios, failure to keep up with changes in consumer lifestyles and damage to our reputation due to delays in responding to climate change mitigation and adaptation are significant risks for our Group. However, we believe that by developing and implementing a business strategy that can quickly respond to both the 1.5℃/2℃ and 4℃ world scenarios ahead of our competitors through continuous scenario analysis, we can turn risks into opportunities.

For example, in the 1.5°C/2°C scenario, carbon taxes and strengthened regulations related to energy conservation are expected, which will lead to increased costs for the Group. As of 2030, the risk that will have the greatest impact on finances is the increased costs due to the introduction of a carbon tax, which is expected to amount to approximately 1.7 billion yen.

However, as regulations on energy conservation and zero-energy buildings progress toward decarbonization, and regulations on greenhouse gas emissions are strengthened, and we respond to the accompanying changes in social awareness, we believe that the growing demand for products with high energy efficiency and low greenhouse gas emissions also represents an opportunity for our Group, which operates home appliances and renovation businesses.

In the 4°C scenario, natural disasters will become more severe, resulting in damage from disasters, and supply chain disruptions will cause delivery delays, resulting in lost sales opportunities. However, as the average temperature rises, energy consumption by air conditioners will increase to keep the room temperature and humidity constant within the company, and air conditioning costs are expected to increase. We believe that the growing demand for energy-efficient air conditioners will also be an opportunity for the Group.

By identifying the impact of climate-related risks through this scenario analysis and considering countermeasures, we aim to reduce risks to our group's business, realize opportunities for value creation, and ensure sustainable and stable profits over the long term.

The main risks and opportunities facing the Group are as follows:

Identifying risks and opportunities posed by climate change

[Initiatives and responses based on risks and opportunities]

Based on the results of the scenario analysis, our Group is strengthening our decarbonization efforts in store facilities and business activities. Aiming to reduce CO2 emissions at stores, we are promoting the use of renewable energy through the installation of solar power generation equipment, introducing energy-saving equipment such as LED lighting, and working on energy control by installing energy management systems (EMS) and introducing energy-saving parts for air conditioning equipment. In addition, in our business activities, we are proactively working to realize a decarbonized society by providing energy-saving products and services to customers, installing electric vehicle charging stations in on-site parking lots, and greening the grounds, rooftops, and walls. We will continue to study energy-saving efficiency at stores and other facilities, while working to strengthen our environmentally friendly and efficient store systems.

As one of the goals is to reduce the costs of responding to the strengthening of regulations under the 1.5°C scenario, we are introducing self-consumption solar power generation equipment, switching to energy-efficient lighting and air conditioning equipment, and entering into demand response (DR) contracts in line with equipment renewal periods, tenant replacements, and new store openings. In addition, at our Gifu Masaki store and Katano Hoshida store, which opened in 2023, we have been working on thorough energy conservation and energy creation to achieve sustainable store operations, and have succeeded in reducing annual primary energy consumption by 25% or less through energy conservation and energy creation, earning the "Nearly ZEB" certification.

In addition, as part of our energy-saving and power-saving initiatives at our directly-operated electronics stores, we are working to reduce CO2 emissions by turning off lights in pylons and on exterior wall signs, setting the temperature of in-store air-conditioning equipment, properly cleaning air-conditioning filters, promptly turning off in-store lights, and turning off some of the power to display items. These efforts are contributing to a reduction in the total amount of Scope 1 and Scope 2 CO2 emissions by reducing electricity and gas usage.

In the home appliance and renovation business, which accounts for more than 80% of Net sales, our group sees this as an opportunity to actively promote sales of highly energy-efficient home appliances, home solar power generation equipment, and high-insulation renovations. We are promoting the increase of employees with a wide range of specialized knowledge in the field of energy conservation through qualifications and training such as home appliance advisors and smart masters at stores nationwide. This initiative contributes to reducing CO2 emissions in Scope 3 Category 11 (use of sold products) and Scope 3 Category 1 (purchased products and services) through the supply chain. In addition, some of our logistics service bases reduce the volume and recycle polystyrene foam discharged during product delivery, which reduces the number of transport vehicles to 1/20 of the usual number, thereby reducing CO2 emissions in Scope 3 Category 4 (transportation and delivery).

To reduce damage and response costs associated with the intensification of natural disasters envisioned in the 4°C scenario, we have envisioned the risks of flooding and inundation, as well as damage from flooding due to torrential rain, and have established a system for responding to risks, such as conducting disaster prevention drills so that we can respond as quickly as possible. In addition, to minimize the risk of flooding in our offices and stores in the event of record-breaking heavy rains or torrential rains, and damage to home appliances due to flooding, we have installed drainage pumps in some stores and carried out waterproofing work on rooftops and parking lots. We will continue to make appropriate plans and prepare for natural disasters through repairs, operations, training, and the use of external information.

Our group is committed to the proper disposal of used home appliances that are subject to the Act on Recycling of Specified Household Appliances (Home Appliance Recycling Act), as well as the separation and recycling of waste materials such as polystyrene foam. Our subsidiary, ER Japan Co., Ltd., recycles used small home appliances collected by group companies and reuses computers, and we recognize that contributing to the realization of a sustainable recycling-oriented society is a corporate social responsibility. In addition, our group has been participating in forest maintenance activities such as tree planting for over 15 years and is actively involved in preserving the natural environment.

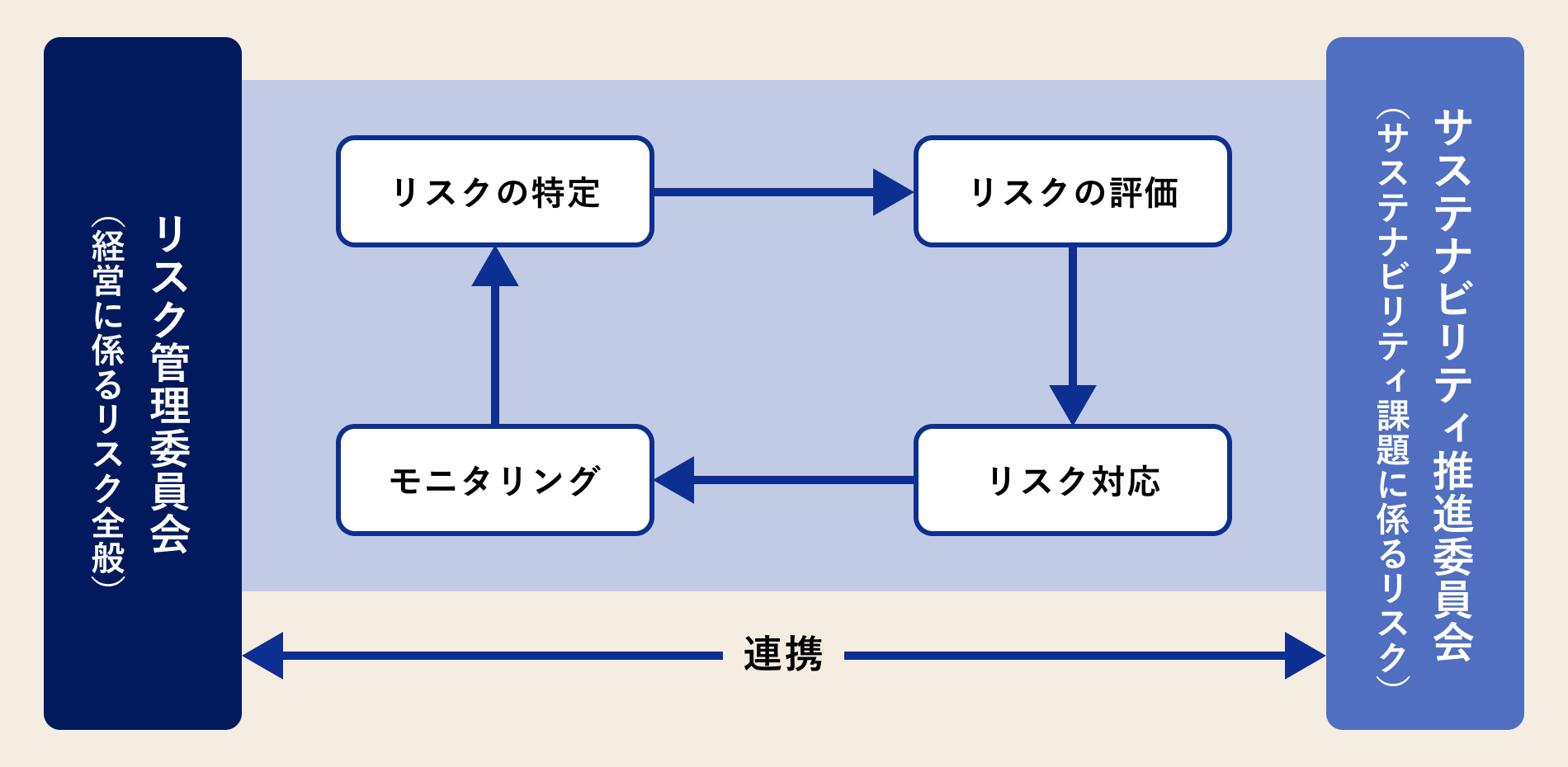

Risk management

The Sustainability Promotion Committee evaluates and manages risks and opportunities related to climate change. It manages company-wide climate change risks and opportunities, and also discusses and decides on methods for identifying, evaluating, and managing risks and opportunities, before reporting to the Board of Directors. Identified climate change-related risks are classified into "transition risks" and "physical risks," and the financial impact is evaluated. After identifying significant risks and opportunities, the committee discusses countermeasures with the Risk Management Committee.

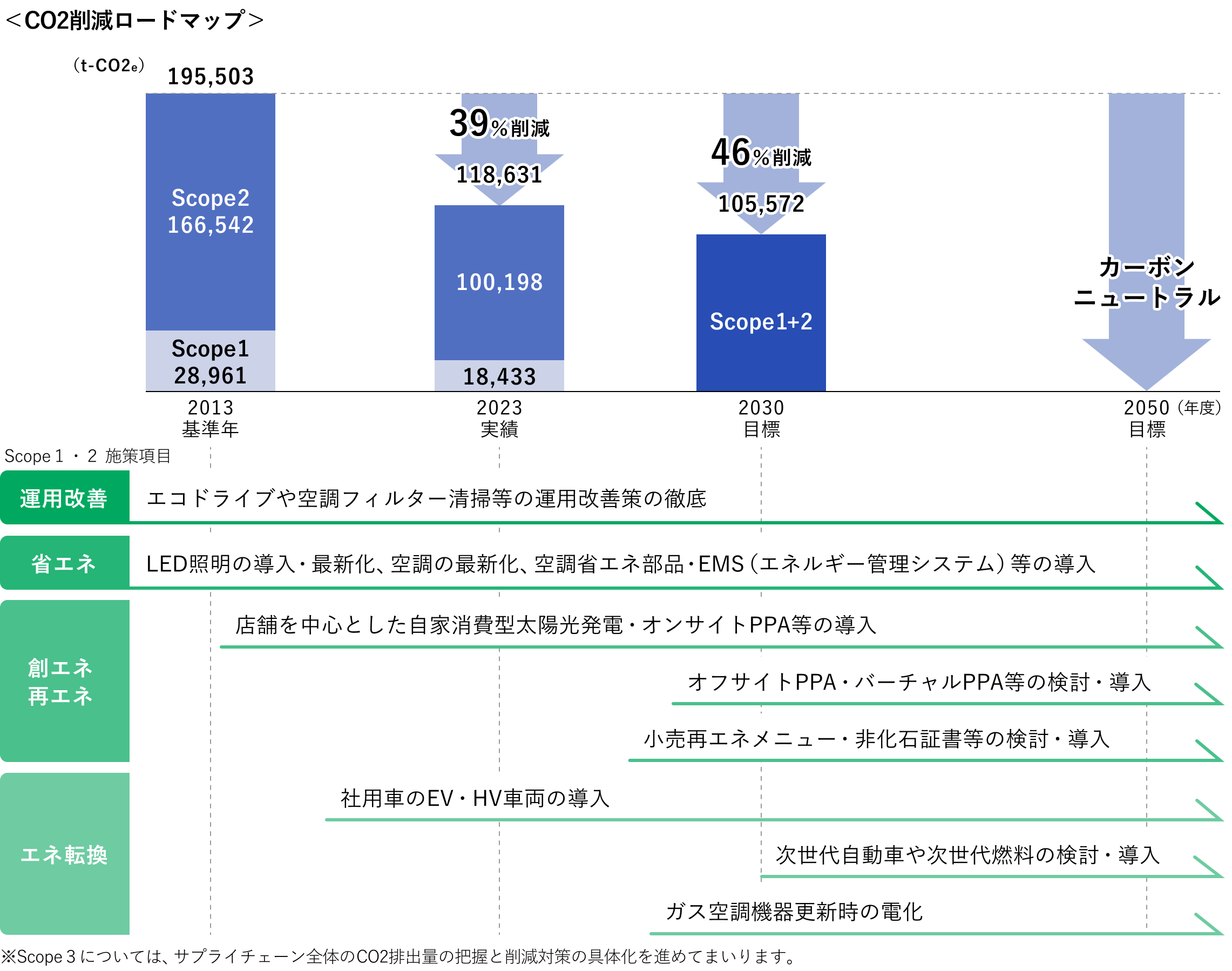

Indicators and targets

[Indicators and targets]

The Group has set Scope 1, 2, and 3 CO2 emissions as indicators for managing risks and opportunities due to climate change. The Group aims to reduce its total Scope 1 and Scope 2 CO2 emissions by 46% compared to fiscal 2013 by fiscal 2030, and in the long term, aims to achieve carbon neutrality by fiscal 2050. In order to steadily achieve this reduction target, the Sustainability Promotion Committee formulated a CO2 reduction roadmap in March 2025. We will systematically and step-by-step promote the CO2 reduction roadmap by improving the operation of energy-saving activities, updating to highly efficient LED lighting and air conditioning equipment, expanding the introduction of solar power generation equipment, and introducing EV and HV vehicles for company cars. As for Scope 3, we will continue to grasp the CO2 emissions of the entire supply chain and concretely implement reduction measures.

[CO2 emissions (Scope 1, 2, 3)]

The Group is working to calculate the Group's overall CO2 emissions from its business activities. The Group's combined Scope 1 and 2 CO2 emissions for fiscal year 2024 will be 120,201 t-CO2e (a 38.5% reduction compared to fiscal year 2013). Additionally, Scope 3 CO2 emissions for fiscal year 2024 will be 10,117,475 t-CO2e (a 4.7% reduction compared to fiscal year 2022). The trends in the Group's Scope 1, 2, and 3 CO2 emissions are as follows:

< EDION Group Scope 1 and 2 CO2 emissions results>

(Unit: t-CO2e)

| Fiscal Year 2013 Base year | 2022 | 2023 | 2024 | 2024-2013 Comparison (rate of increase/decrease) | ||

|---|---|---|---|---|---|---|

| Scope 1 Direct emissions from the Group (Gas, petrol, diesel, etc.) | 28,961 | 20,273 | 18,433 | ✔ | 21,104 | 72.9%(△27.1%) |

| Scope 2 Supplied by other companies Indirect emissions (electricity, etc.) | 166,542 | 85,470 | 100,198 | ✔ | 99,096 | 59.5%(△40.5%) |

| Scope 1 + Scope 2 Total | 195,503 | 105,743 | 118,631 | ✔ | 120,201 | 61.5%(△38.5%) |

- Figures for fiscal 2024 marked with a ✓ have been third-party assured.

- *Applies to our company and its consolidated subsidiaries.

- * Scope 1 energy-related CO2 emissions are calculated using the emission coefficients published by the Ministry of the Environment and the Ministry of Economy, Trade and Industry in accordance with the Global Warming Countermeasures Act.

Additionally, emissions of fluorocarbon alternatives (HFCs) are calculated in accordance with the Fluorocarbons Emissions Control Law and are included in Scope 1. - * Market standards are used for Scope 2. The CO2 emission coefficient for electricity uses the adjusted emission coefficients for each electric power supplier for each year published by the Ministry of the Environment and the Ministry of Economy, Trade and Industry.

- * If figures are rounded, the total may not necessarily equal the sum of the figures.

< EDION Group Scope 3 CO2 emissions results>

(Unit: t-CO2e)

| 2013 | Fiscal Year 2022 Base year | 2023 | 2024 | 2024-2022 Comparison (rate of increase/decrease) | ||

|---|---|---|---|---|---|---|

| Scope 3 Values other than Scope 1 and 2 -Indirect emissions along the chain | 61,780 | 10,613,896 | 10,554,915 | ✔ | 10,117,475 | 95.3%(△4.7%) |

< EDION Group Scope 3 Breakdown by Category>

(Unit: t-CO2e)

| Scope 3 category/year | 2013 | Fiscal Year 2022 Base year | 2023 | 2024 | Scope 3 for the most recent fiscal year Composition ratio within category | |

|---|---|---|---|---|---|---|

| 1. Purchased Products and Services | 27,064 | 2,100,553 | 2,108,690 | ✔ | 2,227,460 | 22.0% |

| 2. Capital Goods | ー | 21,041 | 71,604 | ✔ | 52,686 | 0.5% |

| 3. Not included in Scope 1 or 2 Fuel and Energy Activities | 19,970 | 14,422 | 14,551 | ✔ | 20,300 | 0.2% |

| 4. Transportation and delivery (upstream) | ー | 38,026 | 38,362 | ✔ | 38,717 | 0.4% |

| 5. Waste generated from business operations | 14,746 | 23,641 | 21,313 | ✔ | 21,320 | 0.2% |

| 6. Business trips | ー | 1,212 | 1,200 | ✔ | 1,214 | 0.0% |

| 7. Employee Commuting | ー | 5,077 | 4,959 | ✔ | 4,707 | 0.0% |

| 8. Leased assets (upstream) | ー | ー | ー | ー | ー | |

| 9. Transportation and distribution (downstream) | ー | ー | ー | ー | ー | |

| 10. Processing of sold products | ー | ー | ー | ー | ー | |

| 11. Use of sold products | ー | 8,306,605 | 8,189,305 | ✔ | 7,683,624 | 75.9% |

| 12. Disposal of sold products | ー | 85,200 | 85,404 | ✔ | 50,932 | 0.5% |

| 13. Leased assets (downstream) | ー | 7,840 | 9,121 | ✔ | 9,915 | 0.1% |

| 14. franchised | ー | 9,910 | 10,037 | ✔ | 6,300 | 0.1% |

| 15. Investment | ー | 370 | 370 | ✔ | 300 | 0.0% |

| Scope 3 Total | 61,780 | 10,613,896 | 10,554,915 | ✔ | 10,117,475 | 100.0% |

- Figures for fiscal 2024 marked with a ✓ have been third-party assured.

- *Except for categories 11 to 15, this applies to our company and its consolidated subsidiaries.

- * Due to clarification of the standards for aggregation, etc., the calculation methods for Categories 4 and 9 have been partially revised, and the values for FY2022 and FY2023 have been retroactively revised.

- *Categories 1 to 7 are calculated using the emissions intensity figures from the Ministry of the Environment database (Version 3.5) for the amount of activity of our company and its consolidated subsidiaries.

- *Category 8 is included in Scope 1 and 2.

- * Category 9 has not been calculated because a reasonable calculation is difficult, except for transportation and delivery, which is included in category 4.

- * Category 10 does not apply.

- * Category 11 is calculated using the emission factors published by the Ministry of the Environment and other organizations for the lifetime energy consumption of home appliances and kerosene/gas products sold by our company and two consolidated subsidiaries.

- * Category 12 is calculated using the emissions intensity from the Ministry of the Environment's database (Version 3.5) to estimate the amount of waste generated when products sold by our company and our three consolidated subsidiaries reach their end of life.

- * Category 13 is calculated using the total floor area of properties leased by our company and the emissions intensity by building use from the Ministry of the Environment's database (Ver. 3.5).

- *Category 14 is calculated using the average intensity calculated based on the actual Scope 1 and 2 emissions of EDION alone for the total floor area of franchised stores of the Company and its two consolidated subsidiaries.

- *Category 15 is calculated based on the publicly disclosed GHG emissions (Scope 1 and 2 emissions) of some of our investments and our shareholding ratio (coverage rate of 12% of stocks).

- * If figures are rounded, the total may not necessarily equal the sum of the figures.

[Third-party assurance]

To increase the reliability of the environmental data (Scope 1, 2, and 3) that the Group discloses, the data is assured by a third party, Sustainability Standard Partners, Inc.

![[Japanese] Independent Third-Party Assurance Report](/sites/default/files/inline-images/tcfd_05_01.png)