■ Business performance for the first half of fiscal 2024

During the current interim consolidated fiscal period, the future of the Japanese economy remains uncertain due to the prolonged situation in Ukraine, the worsening situation in the Middle East, the slowdown in the Chinese economy, rising prices due to soaring raw material and energy prices, and the impact of rapid exchange rate fluctuations.

On the other hand, although personal consumption is affected by prolonged high prices for food and daily necessities, it is expected to recover due to an improvement in the income environment resulting from capital investment, mainly by large companies, and wage increases. In addition, the domestic consumer market is recovering, with inbound demand expected to expand further due to an increase in the number of overseas tourists as the yen weakens and the recovery from the COVID-19 pandemic continues.

Under these circumstances, our corporate group is working to strengthen corporate governance in order to flexibly respond to the rapidly changing business environment and further strengthen our management structure, thereby improving our corporate value. To this end, following a resolution to amend the Articles of Incorporation at the General Meeting of Shareholders held on June 27, 2024, we have transitioned from a company with an audit and supervisory board to a company with an audit and supervisory committee, and at the Board of Directors meeting held on the same day, we resolved to change the representative director. This will enable the Board of Directors to flexibly delegate business execution authority to directors, which will improve the agility and speed of decision-making in business execution, and we will strive to further improve our corporate value.

In addition, we acquired all shares of Muroyama Transport Co., Ltd. on August 1, 2024, making it a consolidated subsidiary. The company has been involved in the logistics industry for many years, mainly in the Kinki and Chugoku-Shikoku regions, and has built a good relationship with us as a cooperative partner. We believe that bringing the company into our group will lead to the resolution of various logistics issues, including the so-called 2024 problem, as well as progressive growth.

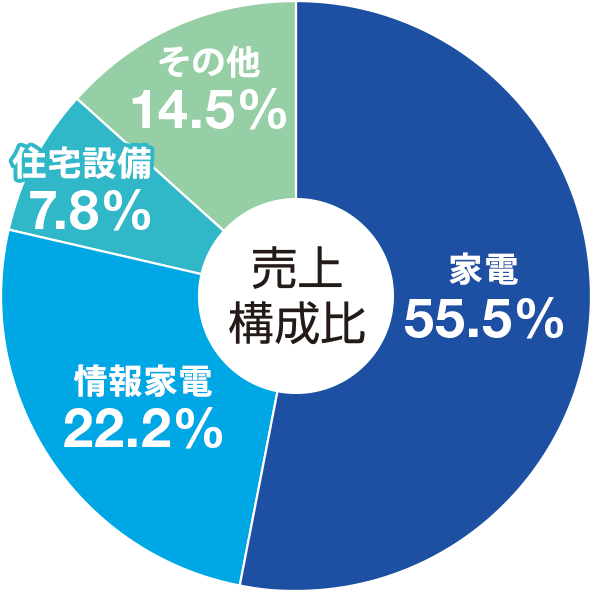

In terms of product sales for the current interim consolidated accounting period, seasonal home appliances such as air conditioners contributed significantly to the increase in sales due to the continued heat wave across the country, with the "monthly average temperature in Japan" in July 2024 reaching the highest record since statistics began in 1898. In addition, mobile phones, mainly iPhones, continued to perform well from last year.

In addition, sales of housing equipment grew, centered on high-efficiency water heaters, which were supported by the Ministry of Economy, Trade and Industry (Hot Water Energy Saving 2024 Project), and double-glazed window renovations, which attracted attention for their high insulation performance due to the aforementioned heat wave. Furthermore, sales of beauty and health equipment, household appliances such as microwave ovens and cooking appliances, and visual appliances such as televisions also increased from the previous year, showing steady growth.

As a result of the above, Net sales to 380.5 billion yen (107.9% compared to the same period last year), operating profit increased to 14,498 million yen (134.5% compared to the same period last year), Ordinary income increased to 15,027 million yen (136.0% compared to the same period last year), and interim net profit attributable to owners of parent increased to 10,031 million yen (139.0% compared to the same period last year).

■ Outlook for fiscal 2024

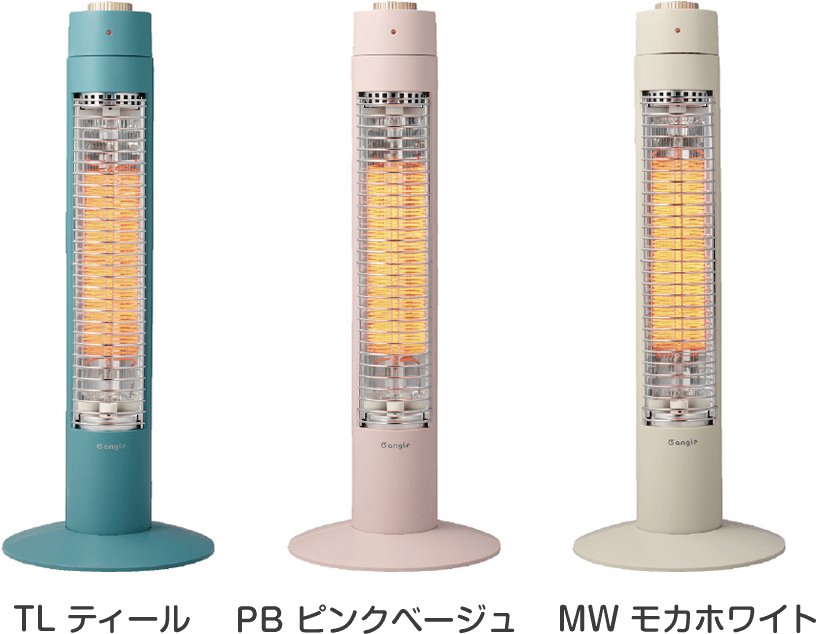

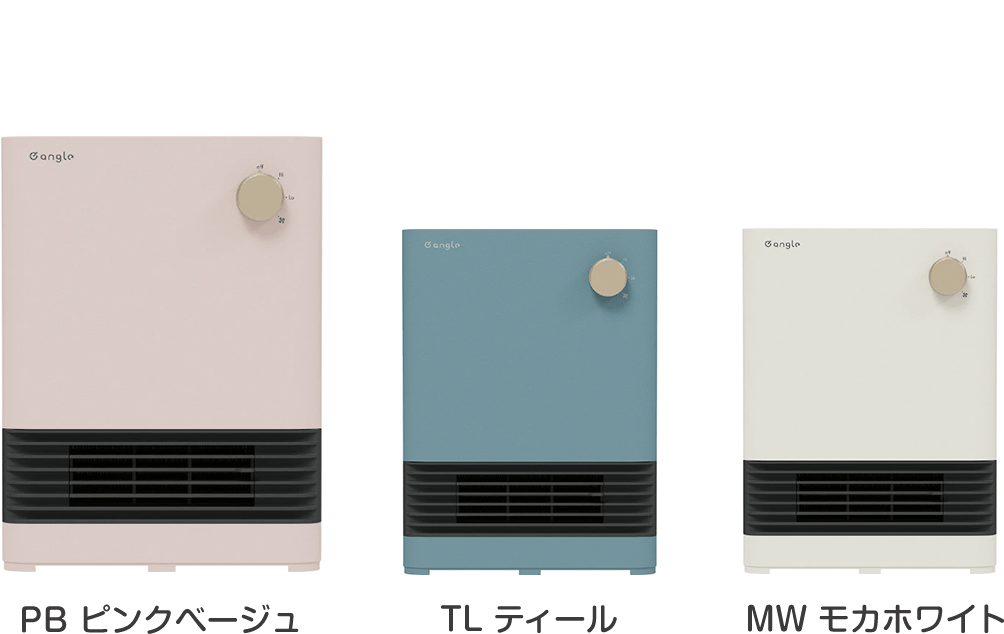

In the second half of 2024, while the outlook for domestic consumption trends remains uncertain due to rising prices and the impact of the weak yen, we will continue to expand our product lineup by selling value-added products such as energy-saving air conditioners and refrigerators and strengthening development of our private product "e angle angle," strengthen our sales structure to meet further inbound demand, and actively develop and sell products and services that meet customer and market needs.

Furthermore, in addition to strengthening sales of renovation products, mainly residential equipment such as EcoCute and double-glazed windows, which performed well in the first half of the year, we will strive to further improve convenience and customer satisfaction through service-based sales that leverage our strengths, such as providing support for cleaning home appliances such as air conditioners, kitchens and bathrooms, and proposing advantageous plans for switching to mobile phones and internet lines with an awareness of money-saving measures.

Regarding new store openings, we plan to open two new stores in the second half of this fiscal year, bringing the total to seven new stores for the full year, including the five stores opened in the first half of the fiscal year.

In addition, with regard to our full-year consolidated earnings forecast for the fiscal year ending March 2025, we have revised it upward from the previous forecast (published on May 10, 2024) taking into account the results of this interim consolidated accounting period.

Our full-year forecast is for Net sales 761.5 billion yen (105.6% compared to the previous fiscal year), operating profit of 22.2 billion yen (131.1% compared to the previous fiscal year), Ordinary income 23.1 billion yen (133.2% compared to the previous fiscal year), and Profit attributable to owners of parent 13.5 billion yen (149.6% compared to the previous fiscal year).

Going forward, we will continue to support our customers to make their lives more convenient and enriched, and will strive to ensure strict compliance while expanding sales and profits. We will also strengthen our human capital and sustainability management, and work to achieve sustainable business growth and improve our corporate value while also solving social issues.